Financing your electric bike is now easier than ever. With rising fuel costs and better access to EV loans, more people are switching to electric scooters without burning a hole in their pockets. From bank loans to dealer EMI schemes, flexible options are available for every type of rider—whether you’re a student, a delivery professional, or a working adult.

How to Choose the Best EMI Plan for Financing Your Electric Bike?

Start by comparing your options—some dealers offer instant approvals, while banks may offer better rates. A good EV bike loan should come with:

- Low interest rates

- Minimal processing charges

- Flexible tenure

Look for electric bike EMI options that don’t stretch your monthly budget. Some banks also offer electric bike financing options that include insurance and registration costs bundled in.

What Is the Best Way to Finance an Electric Bike in India?

Here’s how you can get the best electric bike price deals today:

- Choose state-backed models like Komaki that qualify for subsidies

- Use public sector banks offering green vehicle loans

- Ask dealers about seasonal offers with 0% EMI

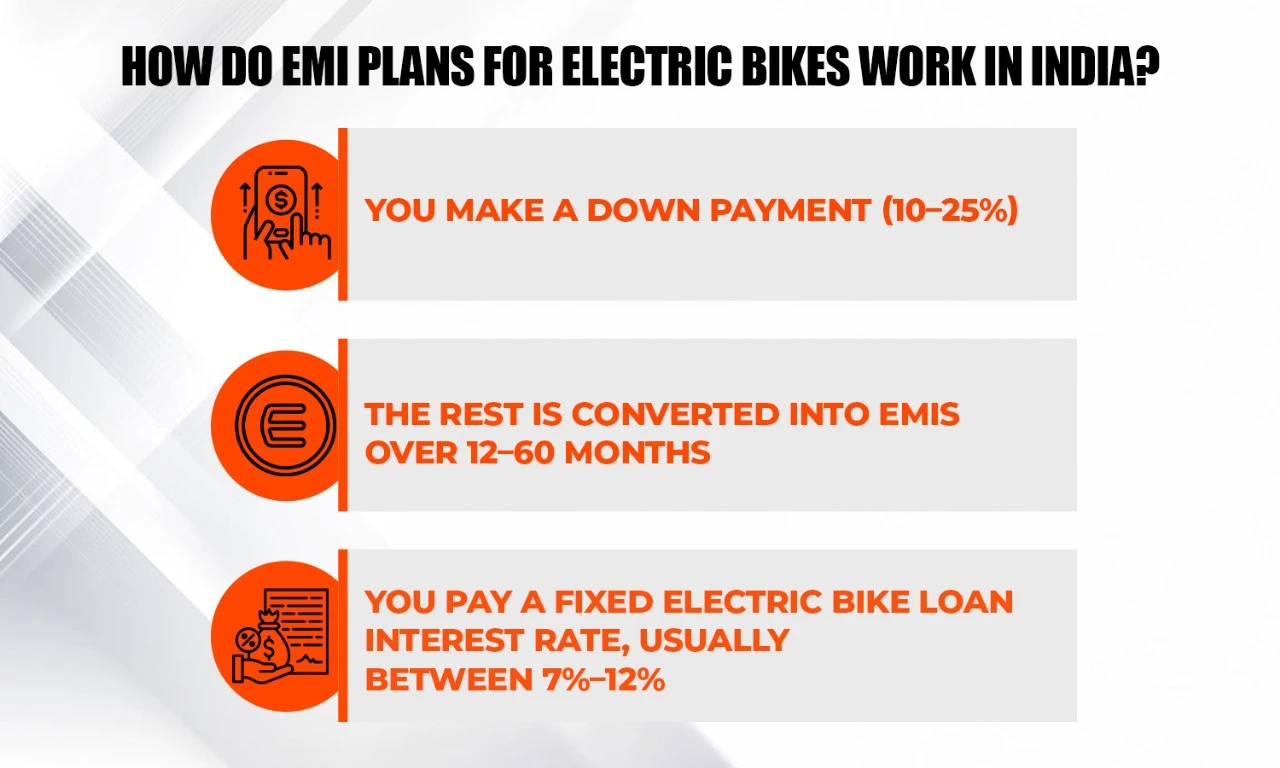

How Do EMI Plans for Electric Bikes Work in India?

The process is simple. Once your loan is approved:

- You make a down payment (10–25%)

- The rest is converted into EMIs over 12–60 months

- You pay a fixed electric bike loan interest rate, usually between 7%–12%

Many NBFCs and banks now offer dedicated EMI plans for electric bikes, giving you flexibility and peace of mind.

Are There Any Government Schemes That Support Financing Your Electric Bike?

Yes, central schemes like FAME II and state-level incentives in Delhi, Maharashtra, and Gujarat can reduce your overall cost. This makes owning an EV possible even for those looking for affordable electric bike prices.

On top of that, Komaki’s models offer high value with low electric bike cost, minimal maintenance, and zero fuel dependency.

Conclusion

Financing your electric bike is no longer a hassle. Whether you’re looking for the best electric bike rate or want to avoid a big upfront payment, EMI and loan options are right within reach. With Komaki, you get transparent pricing, good range, and long-term savings—all while riding cleaner.

Key Takeaways

- Financing your electric bike makes EVs affordable for everyone

- Choose EMI plans that match your budget and offer low interest

- Komaki EVs start around ₹35,999 on-road with easy loan options

- Government schemes reduce both upfront and loan burden

- Smart financing = lower running costs + eco-friendly mobility

Frequently Asked Questions

What is the average EMI when financing your electric bike?

Depending on price and tenure, your EMI can range from ₹2,500–₹3,500/month for a Komaki EV.

Are electric bikes cheaper to finance than petrol ones?

Yes. Due to lower cost, subsidies, and low electric bike loan interest rate, EVs are easier on the wallet.